Purchased Office Furniture Journal Entry

100000 Purchased from Sai Industries with GST12.

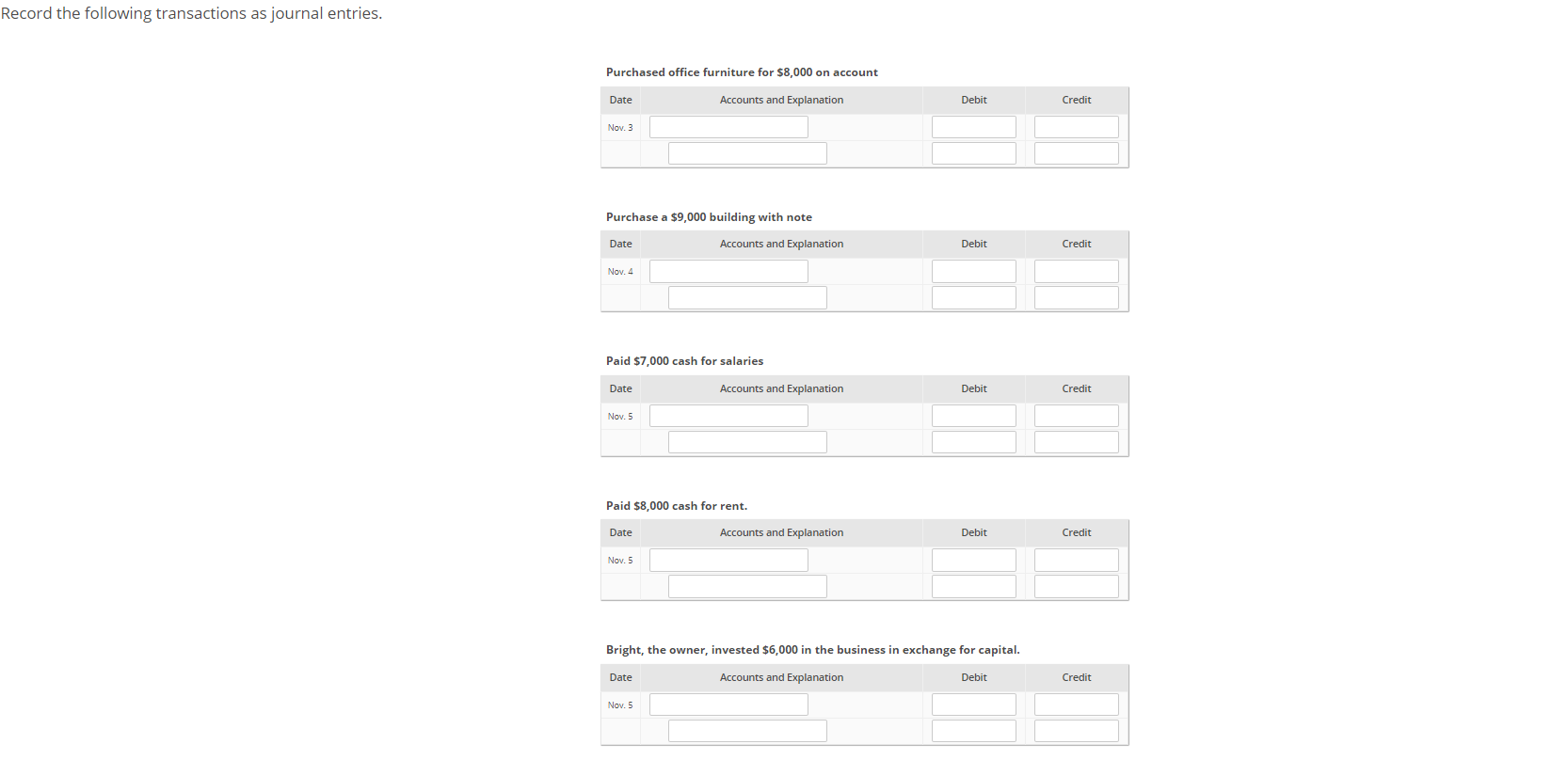

Purchased office furniture journal entry. 4000 from Hari he allowed us 10 trade discount. Timber purchased from Deepak Furniture for cash Rs. In trading business journal entry for goods purchased is the second steps of financial transaction recording.

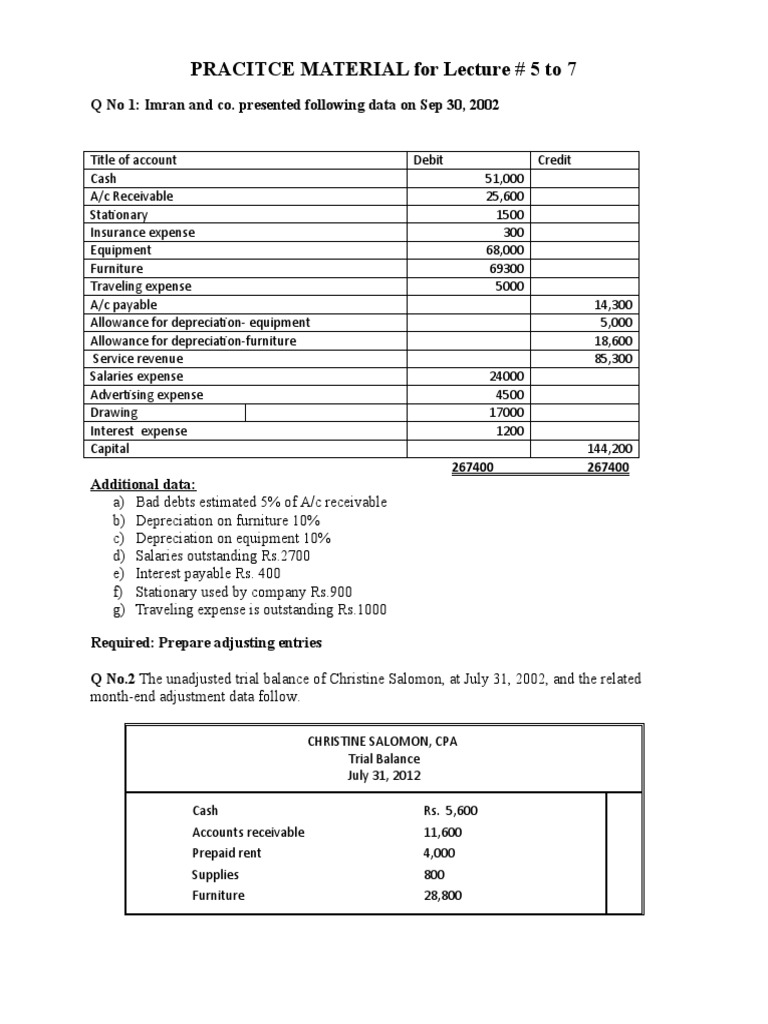

After purchasing goods they are sold. The journal entry is as follows. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase.

A Debit equipment for Rs. Since filing cabinet is a form of office furniture and that the cartage is a direct expense associated with the same the entry would be Office Furniture Account Dr. Upon furniture purchase the value of an asset is increased and according to the Rules of.

In case of a journal entry for cash purchase Cash account and Purchase account are used. These goods are purchased for resale. 200000 and creditors Rs.

July 31 Iron safe purchased on credit worth Rs 18000. 3000 cash for an insurance policy covering the next 24 months. Bought furniture for resale for 5000 Bought furniture for office decoration for 3000 Journal entry of furniture purchased for office use.

The accounting records will show the following purchased supplies on account journal entry. What would be the Journal Entry for Furniture purchased amounting to Rs. 1000 were to paid him immediately.